TL;DR The Thailand VAT rate is 7% and becomes relevant once a business must register for VAT, which is required when turnover exceeds THB 1.8 million. After registration, companies must charge VAT, issue proper tax invoices, file monthly returns, and keep clear records under Thai Revenue Department rules.

VAT affects your pricing, cash flow, and profit margins. Errors such as late registration, incorrect invoices, or poor documentation can lead to penalties and audits. For foreign investors, VAT in Thailand is more complex, especially with cross-border services and refund claims, so good planning and accurate bookkeeping are important.

Introduction

Whether you are setting up a new company or already operating, it is important to understand your VAT obligations, including when VAT registration is required and when VAT must be charged on invoices.

Although VAT is paid by the end customer, businesses are responsible for registering correctly, issuing compliant tax invoices, and filing returns on time. However, not all businesses are not subject to Thailand VAT registration and not all transactions are subject to VAT.

Mistakes such as registering late, filing incorrectly, or applying VAT to the wrong transactions can quickly lead to penalties, cash flow strain, and unwanted attention from the Thai Revenue Department. For foreign-owned and growing businesses, VAT compliance is often more challenging, particularly where cross-border transactions, strict documentation rules, and coordination with corporate income tax and withholding tax are involved.

At VB & Partners, we support businesses across Thailand with VAT registration, monthly filings, bookkeeping, and tax coordination. Below, we explain how the Thailand VAT rate impacts real business operations and what this means for pricing, cash flow, compliance, and long-term planning.

Key Points

- The standard Thailand VAT rate is 7%, applied to most goods and services

- Businesses collect VAT on sales and claim VAT on eligible expenses

- VAT registration is mandatory once turnover exceeds 1.8 million THB

- VAT directly affects pricing decisions, cash flow, and monthly accounting

- Foreign-owned businesses face additional VAT considerations, especially for cross-border transactions

What Is VAT and How It Works

Value Added Tax, commonly referred to as VAT, is a consumption tax applied to the sale of goods and services in Thailand. The current standard VAT rate is 7%, and it applies to most taxable transactions.

Although VAT is designed to be paid by the end consumer, businesses are responsible for charging VAT on sales (output VAT), paying VAT on purchases (input VAT), and remitting the net amount to the Thai Revenue Department.

Certain transactions are exempt or zero-rated, including specific financial services, exports, healthcare, and education. Correctly identifying which transactions are taxable, exempt, or zero-rated is essential. Misclassification can result in penalties, delayed VAT refunds, or audit issues.

Businesses with annual taxable turnover exceeding 1.8 million THB are required to register for VAT. Smaller businesses may choose voluntary registration, often to recover input VAT on expenses or to meet commercial requirements.

VB & Partners assists businesses in determining VAT applicability and ensuring correct registration from the outset.

Thailand VAT Registration Requirements for Businesses

VAT registration is an important consideration for any business operating in Thailand. Once the 1.8 million THB turnover threshold is exceeded, VAT registration becomes mandatory for both Thai and foreign-owned entities carrying out taxable activities. Once a business exceeds either the monthly or annual VAT revenue threshold, it must apply for VAT registration within 30 days.

VAT registration is also a mandatory requirement for companies who wish to hire foreigners and support their Work Permits.

Some businesses may also choose to register voluntarily before reaching the threshold, particularly if they need to issue VAT invoices or expect to incur significant VAT on expenses. The decision to voluntarily register for VAT should be carefully assessed, as registration requires VAT reporting and monthly filing obligations.

Once a company has registered for VAT they will be issued with a VAT registration number that must appear on all tax invoices, receipts, and accounting records. Failure to register on time or comply after registration may result in fines, surcharges, interest, and increased audit risk.

Once registered, the company will also receive a VAT registration certificate (P.P.20). This certificate confirms the business has been legally registered for VAT from the date listed on the certificate. The VAT registration certificate must be clearly displayed in the place of business.

VB & Partners supports clients throughout the VAT registration process to ensure accuracy, timeliness, and compliance.

Read more:

VAT Registration in Thailand and When to Register

How to Register For VAT?

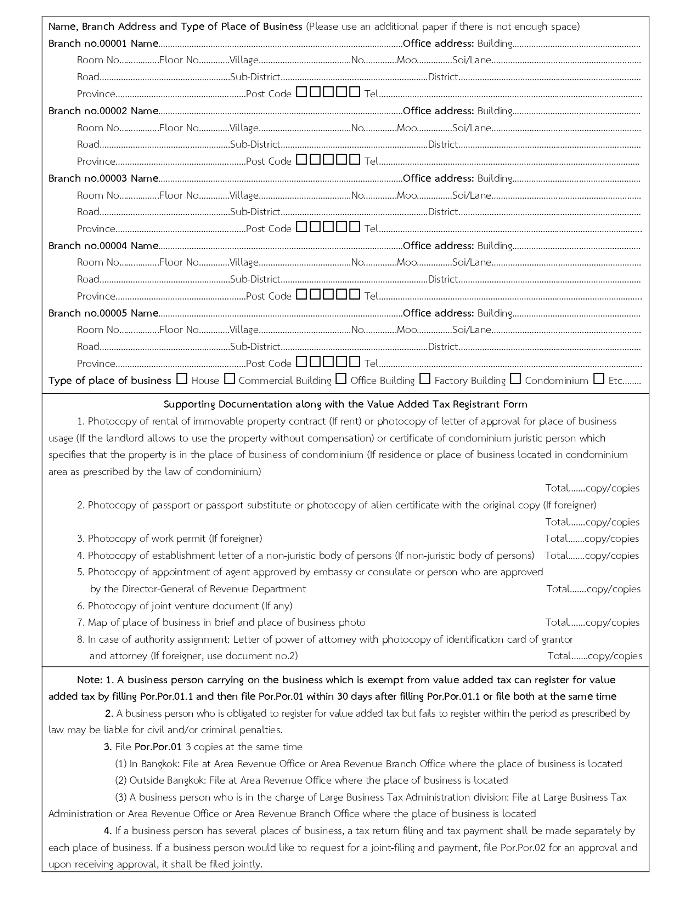

Registering for VAT in Thailand is often more complex than it first appears. One of the most important points to consider is that not every registered company address is suitable for VAT registration in Thailand. The Revenue Department requires businesses to have a proper physical office, this means that a virtual office, condominium unit or co-working address is generally not accepted.

As part of the application process, officers may request photos of the office showing the company name and, in some cases, even request an on-site inspection to confirm the business location.

It is recommended that before agreeing to leasing an office to make sure that your landlord agrees to let you use the premises for VAT registration. This is important because the Revenue Department requires an original letter of consent from the property owner and, if the office is located in a managed building, an additional letter from the building’s juristic person.

As well as the written confirmation from the landlord/juristic office the Revenue Department required the following documents, a copy of the lease agreement, a business plan, and a map highlighting the location of the office. Preparing the business plan properly is important because if the Officers doubt the legitimacy of your business, they may have lots of follow up questions and requests. A properly prepared business plan may help to reduce the risk of additional scrutiny.

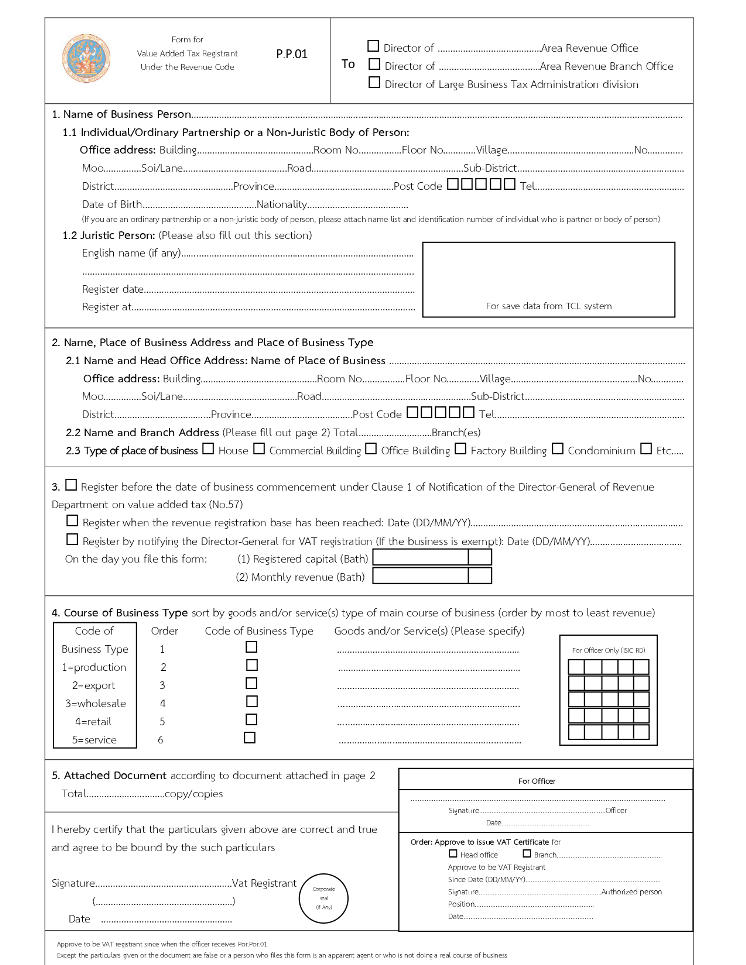

Applicants will also be required to complete the VAT Registration form P.P. 01 to be submitted with the supporting documents.

In practice, preparing all documents can take up to three weeks, as obtaining consent letters and supporting documents often involves processing fees and coordination with multiple parties. Once submitted, the Revenue Department typically takes another two weeks to review the application and issue the VAT registration certificate.

How VAT Affects Pricing and Cash Flow

Even when a business is not required to register, VAT in Thailand should still be considered, as voluntary registration may create opportunities to optimise tax liabilities, such as recovering input VAT and claiming allowable deductions.

Thailand VAT registration affects how prices are presented to customers, whether the Thailand VAT rate must be added to invoices, and how quickly input VAT can be recovered through Thailand VAT reporting.

For some businesses, VAT registration can improve cash flow management by allowing VAT credits on expenses, while for others it may create additional work load due to filing and payment timelines.

To assess whether your current VAT position supports your wider financial strategy, VB & Partners can review your Thailand VAT compliance in the context of pricing, cash flow, and operational planning.

How the VAT Rate Affects Business Operations

Because VAT has an effect on both pricing decisions and cash flow timing, it is important to understand the impact of VAT on your business.

Type of Business Activity

Not all businesses need to register for VAT. If your goods or services are VAT-exempt, or if your company falls under the Specific Business Tax (SBT), VAT registration may not be required at all.

This can keep pricing simpler and more competitive, particularly for customers who cannot reclaim VAT, while also reducing work load due to not having to deal with the VAT filing obligations.

The downside is that VAT-exempt and SBT businesses generally cannot recover input VAT on expenses. This means VAT paid on rent, professional fees, or operating costs becomes an additional cost, which can reduce margins and affect overall cash flow.

Credibility

VAT registration can help to improve a company’s credibility and market reputation. Being VAT registered shows that a business operates formally, complies with tax regulations, and maintains transparent accounting practices.

However, a company without VAT registration may appear small or even raise doubts about whether it fully declares its revenue. If a company is considered as avoiding paying revenue etc, it can create reputation risks when dealing with corporate or international clients. Many larger partners and government entities prefer to work with VAT-registered companies, as it suggests reliability, proper accounting and long-term business stability.

Claiming Input VAT

If your customers are mostly VAT-registered businesses (B2B), registering for VAT allows your clients to claim input VAT, which can help keep pricing competitive. However, if your customers are non-VAT registered consumers (B2C), adding 7% VAT could raise your prices and reduce competitiveness, unless you’re prepared to absorb the cost.

Thailand VAT Reporting Requirements

Thailand VAT registration requires regular filings, issuing proper invoices, and proper bookkeeping.

Businesses must issue properly formatted VAT tax invoices that include mandatory details such as the VAT rate, tax amount, supplier information, and tax identification number, and must retain these records for audit and reporting purposes.

Before registering, it is important to assess whether your internal accounting team has the knowledge and experience to manage these requirements accurately, or whether external accounting support will be needed to handle VAT filings, reporting deadlines, and ongoing compliance.

Cash Flow Impact

If your business makes large upfront purchases, registering for VAT can allow you to reclaim input VAT and improve cash flow. This is particularly relevant for capital intensive businesses like manufacturers, exporters, or companies with significant startup costs.

VAT Compliance and Monthly Reporting

VAT-registered businesses in Thailand are required to submit monthly VAT returns by the 15th day of the following month. The Thai Revenue Department encourages the use of its electronic filing system, and businesses that file through e-Filing benefit from an extended deadline, with the PP30 return due by the 23rd day of the following month.

Each filing must accurately report taxable sales, purchases, input VAT credits, and the resulting VAT payable or refundable for the period.

Proper documentation is important to help make sure the VAT filing process goes smoothly. Tax invoices and receipts must satisfy Thai Revenue Department requirements, and incomplete or incorrect records can lead to delayed refunds, rejected VAT claims, audits, or penalties.

VAT-registered businesses are required to maintain specific records, including issued and received tax invoices, goods and raw material reports, output and input tax reports, and VAT calculation worksheets.

These records must be retained for a minimum period of five years. Electronic storage is permitted, provided it meets the Revenue Department’s technical and record integrity requirements. All VAT records should be maintained in Thai, with appropriate translations kept on file where documents are issued in another language.

VAT Invoices

VAT registered companies are required to issue VAT invoices. Each invoice must clearly display the seller’s VAT registration number, invoice date, customer details, taxable amount, VAT amount, and the total payable.

The words “Tax Invoice” must be prominently shown, along with the seller’s name, address, and tax identification number, the customer’s name and address, a unique invoice number, and a clear description of the goods or services supplied. VAT must be shown separately from the value of the goods or services.

Tax invoices must be issued at the time of supply or upon receipt of payment, whichever occurs first. Where invoices are issued in a foreign currency, the amounts must also be shown in Thai Baht, with the exchange rate used clearly stated.

VB & Partners provides end-to-end VAT compliance services, including bookkeeping, invoice review, and monthly VAT filings.

Special Considerations for Foreign Investors

For foreign investors, VAT in Thailand requires careful attention to when transactions may qualify for VAT exemption or the 0% VAT rate. While both can reduce VAT exposure, they apply in different situations and come with distinct compliance requirements. Understanding the difference between exempt supplies and zero-rated transactions is essential before relying on either treatment.

VAT Refunds and Audit Risk

When a business model consistently generates significant input VAT that cannot be fully offset against monthly output VAT, the only way to recover the excess is to apply for a VAT refund from the Revenue Department. In practice, VAT refund claims almost automatically trigger a tax audit, and refunds are rarely processed quickly, especially when the amount is material. The review will cover VAT filings, accounting records, invoices, contracts, and the overall consistency of the bookkeeping.

If accounting records are incomplete, inconsistent, or improperly maintained, this significantly increases the risk of delays, reassessments, or the Revenue Department identifying unrelated tax issues during the audit. For this reason, VAT refunds are one of the most sensitive areas of Thai tax compliance.

Where a business model is expected to generate high VAT credits on an ongoing basis, it is generally recommended to plan VAT refunds from the beginning of operations, rather than allowing a large balance to accumulate over time. In practice, claiming refunds regularly at an early stage, when transaction volumes are still manageable, tends to reduce audit complexity and risk, compared to submitting a large refund claim after several years of accumulated credits.

In all cases, businesses with recurring VAT refund positions should ensure that bookkeeping and VAT reporting are handled conservatively and accurately from day one, as VAT refunds are closely linked to audit exposure.

Zero-Rated Transactions

Certain transactions in Thailand are subject to a 0% VAT rate. The following categories are eligible for the zero-rate:

- Export of goods from Thailand

- Services performed in Thailand but utilized abroad.

- International transportation via aircraft or sea vessels

- Goods and services supplied to government agencies under foreign aid programs

- Goods and services provided to the United Nations and international organizations recognized under treaties

The Revenue Department uses the following criteria to determine whether a service qualifies for the zero VAT rate:

- The service must be performed in Thailand

- The service must be utilized entirely outside of Thailand

- The service must not have any direct connection to goods or property in Thailand

The Thai tax authorities apply a wide interpretation of VAT applicability, requiring that services performed in Thailand for foreign recipients must be used entirely outside of Thailand to qualify for the 0% VAT rate. Full supporting documentation must be maintained to ensure compliance in the event of an audit or review.

Read more:

VAT Registration & Thailand Value Added Tax: 0% Rate

VAT Exemptions

In addition to zero-rated transactions, certain goods and services are entirely exempt from VAT. Common exemptions include:

- The sale and import of specific products

- Professional services such as medical, audit, and regulated legal services

- Services provided by Thai governmental organizations

- Land transportation services

- Educational services provided by recognized schools

- Cultural services, such as those offered by libraries and museums

- Rent on immovable property such as real estate

- Religious and charitable services

- The purchase and import of raw gemstones (e.g. sapphires, rubies) by companies licensed to manufacture jewellery for export, provided the company is VAT-registered and the stones are used exclusively for export production.

VB & Partners supports foreign-owned businesses by integrating VAT into their wider financial planning, helping reduce risk and make ongoing compliance more manageable.

Our Thoughts

Based on our experience advising businesses across Thailand, VAT is frequently underestimated as an operational risk. While the Thailand VAT rate itself is straightforward, challenges arise from incorrect application, weak documentation, and poor integration with accounting systems.

Businesses that treat VAT as an opportunity, rather than a monthly filing exercise, are better positioned to maintain cash flow stability, protect margins, and scale with confidence.

Our view is that proactive VAT planning, supported by accurate bookkeeping and professional oversight, transforms VAT from a source of risk into a manageable and predictable component of business operations.

If you would like to review your VAT position or require support with registration, reporting, or strategic planning, VB & Partners is available to provide clear, practical guidance tailored to your business.

Disclaimer

This information is provided for general informational purposes only and is not legal, tax, or financial advice.